This article explores the concepts of crowdfunding, tokenisation and REITs, focussing on their distinctive attributes and major advantages/disadvantages.

Introduction

Conventional fundraising and governance has undergone a sea change over the past many decades. Starting from 1960s, REITs gained prominence as the vehicle to provide access to an otherwise illiquid market – real estate. With time, the wisdom of the crowds in the financial world manifested with the emergence of crowdfunding, which was not limited to real estate but could be used to funnel funds for activities as diverse as raising donations or financing a yet-to-be developed project. Not only did this transform the entrepreneurial landscape, it also provided access to such ideas/projects which were otherwise only available to the ‘sophisticated investors’. Use of tokenisation and distributed ledger technologies has further enhanced the efficiency and transparency in the system, brining upon a paradigm shift in the existing structures. However, it is often seen that these terms are used interchangeably which may lead to conceptual confusion and may act as an impediment in identifying the most suited mechanism for undertaking a venture or an investment decision. This article, therefore, is an effort to elaborate upon and unpack the nuanced understanding of crowdfunding, tokenisation and REITs.

Crowdfunding

Crowdfunding, as the name suggests, is a mechanism to raise funds from a large number of people (with small ticket size) for a specific project, usually facilitated by a digital intermediary. Crowdfunding can be used to raise funds for a development of a product to be sold commercially, or for helping someone achieve their education goals or to fund someone’s medical treatment or even to invest in a property. Based on the revenue model adopted, crowdfunding can be undertaken in the following ways[1]:

Reward and donation-based crowdfunding

In reward and donation-based crowdfunding, in exchange for the funds, the funder is not reimbursed financially, but receives a reward (e.g. pre-sale product/deep discounts) or have other motivations (charitable and philanthropic) for supporting the project.[2] For example,a videogame developer requiring capital for developmental phase of production can create a profile on Bidayatech (a reward-based crowdfunding platform in Bahrain) and list the campaign for public viewing. As a reward for funding the campaign, the developer may promise early access and exclusive in-game items and skins to the funders.[3] This model of crowdfunding is mostly unregulated as the returns (if any) are non-financial in nature. However, other laws such as consumer protection, data privacy and any other contractual obligations continue to be applicable.

Equity-based crowdfunding

In equity-based crowdfunding, in exchange for the funds, the funder invests in the project/company and receives part ownership/shares in the project/company. Since equity crowdfunding amounts to soliciting funds from general public in exchange for securities, this category of crowdfunding is often regulated, albeit with a light touch approach (relative to an IPO). FundedbyMe MENA is a regulated equity based crowdfunding platform in the UAE.

Real estate crowdfunding is a specific category of equity crowdfunding (in some cases, may be structured as debt crowdfunding as well). In this, the real estate asset is funded by a group of funders, who have a right of ownership in the special purpose vehicle which holds the real estate asset pro rata to their funding. After the real estate asset is leased out, funders may receive payouts as dividends and may also have an upside/downside based on the price of the asset at the time of exit. [4]

Debt-based crowdfunding [5]

Also known as peer-to-peer lending and crowdlending, debt crowdfunding mirrors a debt transaction. It involves raising funds with a promise that the funds will be paid back alongwith an agreed interest rate. In debt-based crowdfunding, the entity raising the funds pays back the funds along with some coupon rate/ interest rate pre-agreed between the parties instead of parting with equity/reward. Beehive is an example of a debt-based regulated crowdfunding platform in the UAE.

Crowdfunding – Advantages and Disadvantages

In 2019, the global crowdfunding market size was $13.9 billion[6] and is expected to grow at a compound annual growth rate of over 16% between 2020 and 2025.[7] While crowdfunding remains in its nascent stages in the UAE and the wider Middle East market, the focussed efforts in promoting alternative funding mechanisms has resulted in several crowdfunding platforms setting up in the region. Being a relatively new model, it is imperative to understand its various benefits and pitfalls.

Advantages

An alternative financing/investment option

For entrepreneurs or small businesses, which may not be able to access financing by way of venture capital, bank loans or through other conventional lenders, crowdfunding offers a low-cost access to capital.

At the same time, funders can fund ideas/projects that they find appealing for nominal amounts or may even receive returns (in case of equity/debt crowdfunding). As an illustration, a funder may be able to own a part of premium real estate asset with an investment of as low as USD 5,000.

Interaction with potential customers

Acquisition of clients is a major hurdle for any new business. Crowdfunding gives an opportunity to the entrepreneur to market their idea/product to potential customers even before its launch. In reward based crowdfunding, the funders are prospective customers as well; therefore, a successful bid validates the said idea/product and provides a ready base of clients. Moreover, the funders may provide input in the form of suggestions and criticism during the developmental phase of the project. For example, the developers of Shadowrun Online, altered their business plans after receiving several complaints from the investor community.[8]

High level of transparency

Crowdfunding by its very nature, is a direct form of investment, where investors usually know where their money is being put.[9] Crowdfunding platforms such as Kickstarter, often impose transparency-related guidelines for campaigners.[10]

Disadvantages

Risky

Just like any other investment, crowdfunding also poses the risk of potential loss of investment. The project as intended may never take off or fail to deliver the rewards due to fraud or any other business risks. In equity based crowdfunding, even though the funder is part owner of the entity but she does not exercise any real control over the business. Similarly, in real estate crowdfunding, the property prices may fall, the expected rents may not be realised, or the investor may face losses due to mismanagement of the asset.

Low liquidity

Currently, there is lack of developed secondary market wherein one can trade their interests (reward/equity/debt), unlike securities of a public listed entity.[11] As such, exit options are limited. Some of the exit options (besides liquidation) are ‘trade sales, share buyback schemes or sale on the stock market after an initial public offering’[12].

Leaking of important information and copycats

Fundraisers often share valuable details about their product or service with the funder community. In such a system, it is risky to share valuable details about the product or service being funded before launch. By showing a prototype online, the fundraiser may open doors to copycats. The fidget cube, a novelty item which became popular on Kickstarter in 2016, was copied by several Chinese manufacturers.[13]

Tokenization

Tokenization refers to representation of any asset or rights to an asset into a digital representation (a token). Tokenisation pre-dates blockchain, but the use of blockchain and other distributed ledger technologies, provide an infrastructure layer for these tokens to be programmed, stored, transferred or recorded in a transparent and secure manner.

From a functional perspective, tokens are often categorised by the regulators as one of the following, with some differences in nomenclature:

Utility Tokens: These refer to tokens which can be utilised for a particular purpose within the application/platform for which they are developed. As an illustration, Kleros is a blockchain application that crowdsources jurors to resolve disputes on decentralized networks. It has released its native token – PNK (Pinakion), which it calls as a utility token. PNK is used within the Kleros ecosystem by jurors to be selected as an arbitrator. Moreover, the jurors who are a part of the majority decision are rewarded with PNK taken from jurors who supported the minority decision.[14]

Security Tokens: These tokens are similar to traditional securities in that they represent a stock or share/debt of an entity. These are issued through security token offerings (STO) and entail certain rights. They are regulated under the ambit of securities laws in most jurisdictions. As with most securities, they are available outside the platform on which they are developed, and their value is subject to speculation.

Security tokens may be created on-chain or may represent an off-chain asset (commercial documents, real estate, art etc.). The tokenised real world asset continues to exist off-chain with a trusted custodian. Anything with value can be tokenized – even intangible assets such as data, intellectual property and income-based rights.

As an illustration, investors may buy tokens representing a fraction of a real estate asset through a STO with the expectation that as the property price appreciates, their investment will also be profitable. These tokens are akin to investment contracts and as such are categorised as security tokens.

Currency/Payment Tokens: These are designed to function as a means of exchange or payment, just like a currency. They may or may not be government recognised. Just like fiat currencies, currency tokens can be traded for other cryptocurrencies and fiat currencies using centralized or decentralized crypto exchanges or through self-hosted digital wallets. Bitcoin is a famous example of a currency token which is not recognized by any government.

Tokenization – advantages and disadvantages

A report prepared by the PwC in 2019 on crypto assets and tokenization noted that the number of STOs/ICOs jumped from 552 in 2017 to 1,132 in 2018.[15] STOs had already helped in the procurement of nearly $442 million by the end of 2018.[16] The prolific rise of tokenization can also be gauged from the fact that in the near future, nearly 10% of the global GDP will assemble into crypto-assets,[17] which equals a market valuation of nearly $2.67 billion. The widespread adoption of tokenization and issuing of tokenized securities can be attributed to its far reaching benefits. However, legal and regulatory ambiguity has prevented the ubiquitous adoption of tokenization.

Advantages

Increasing access and liquidity

Tokenisation facilitates conversion of an illiquid asset to a tradeable financial asset, which can be offered to investors via Security Token Offering (STO). This has two significant benefits:

(a) a single asset, upon tokenisation, is capable of being fractionally held/controlled/owned by a large number of investors, thus lowering barriers to entry leading to liquidity in the market. [18] For example, a $1 million apartment can be tokenized into 1 million tokens worth $1 each and each of these tokens could be distributed to unique people. Anyone with an internet connection can invest in the tokenized asset, subject to regulatory considerations. This exposes the tokenized asset to a wider and more diverse set of investors, with varying financial capabilities[19]; and

(b) these tokens can be exchanged on secondary markets (privately, over the counter desks, digital exchanges) which are internet based and open for 24X7 trading, eliminating territorial and time related inhibitions.[20]

Using DLT results in immutable proof of ownership, security and transparency

Blockchain is the underlying infrastructure for tokenisation and STOs. It is an immutable, shared and distributed ledger. The information recorded on such a ledger serves as a single source of truth for all the nodes, thus enabling transparent, auditable and secure transactions. So, token holders have access to more information and know who they are dealing with, what their rights are and who has previously owned the token. Such a level of transparency and security substantially improves user confidence.[21]

Better efficiency and speed

Transactions in tokenized assets can take place instantly using smart contracts. For financial transactions, use of blockchain and smart contracts can expedite and condense trade clearing and settlement to nearly real-time, thus eliminating the need for post trade reconciliation.[22] Even for non-financial tokenised assets such as tokenised bills of lading or invoices, reconciliation and settlement is automatic without the need for exchange of any emails or phone calls. Automation promotes disintermediation and reduces the associated administrative burden, thus resulting in higher efficiency and reduced costs.[23]

Programmable tokens: Automated compliance and versatility

Smart contracts are essentially self-executable lines of code which are deployed on a blockchain. They can be used to enable automated security and compliance checks like KYC[24] by converting them into self-executing code which can then be deployed on tokenization platforms to ensure compliance. For example, an ERC1400 standard security token is programmed to automatically enforce specific conditions that relate to legal and regulatory requirements applicable to securities in different jurisdictions and allows for automated compliance of the tokenised asset with pre-defined requirements built in the code.[25] Furthermore, governance structures and business logic can be directly embedded into the token. For example, voting rights can be incorporated into a token. This means that if a decision is to be taken pertaining to the tokenized asset (for example: renovating tokenized apartment), then the token holders can vote on the issue by using a voting dashboard which they can access through that token. Many tasks such as interest and dividend payments can be coded into the token. Additionally, the technology can be theoretically used to tokenize anything which has or will have value. We understand that the tokenizing paradigm will also allow issuers to create highly customizable non-fungible tokens, which may consist of different rights and privileges.

Disadvantages

Legal and regulatory uncertainty

Even though the technology exists for tokenisation, entrepreneurs and investors remain wary on the regulatory front. The foremost concern remains whether a token is regulated or not. Most jurisdictions take a “substance over form” approach, meaning thereby, irrespective of the token classification, if it exhibits characteristics of a regulated product, it will have to comply with the relevant regulatory requirements. Some jurisdictions have enacted specific laws for security tokens and STOs, however, their implementation remains untested. Moreover, uncertainty over the legal status of smart contracts, an essential component of a tokenisation model, also remains a hurdle in effective adoption of these technologies.

Lack of regulated infrastructure

While it is technically possible to tokenise a real world asset into a digital token, concerns such as maintaining integrity between the real world asset and its digital token need to be adequately addressed. While designing a tokenisation project, suitable mechanisms are required to be put in place to ensure that any change in the real world asset manifests in the digital token as well.

Another major reason why tokenisation remains in its infancy is lack of developed secondary markets. Across the globe, many jurisdictions are in the early stages of licensing digital exchanges and digital asset custodians. Till the time these regulated digital exchanges operationalise, it may not be possible to trade the security tokens (except by way of over the counter desks, peer-to-peer exchanges, unlicensed digital exchanges etc.) in the open market. Even where such platforms exist, most of them cater to professional/accredited investors, thus hindering liquidity.

Energy consumption

Blockchain platforms using Proof-of-Work[26] as their consensus protocol consume massive amounts of energy. De Vries estimated the energy consumption of the Bitcoin network as a whole in 2018 to add up to 2.55 gigawatts.[27] This is close to the electricity consumption of Ireland (3.1 gigawatts). However, it is also pertinent to note that a comparable amount of money is spent to maintain global fiat currency architectures as well.[28]

Real Estate Investment Trusts (REITs)

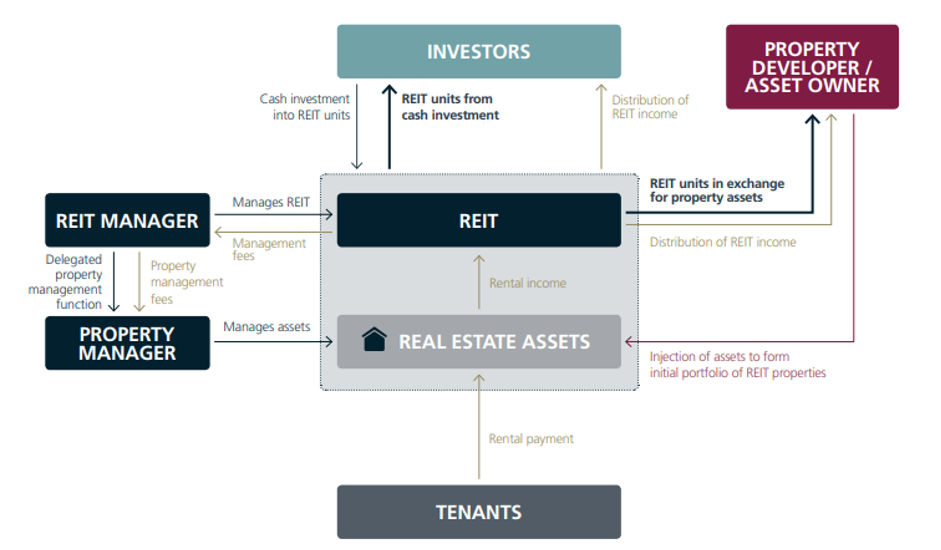

Real Estate Investment Trusts (REITs) are public or private investment funds (incorporated as a trust or a company) that invest in income-generating real estate assets and distribute a stipulated share of its net profits to the unitholders, after making deductions for their management fee. REIT’s essentially convert illiquid real estate asset portfolios to fractions which represent the investors’ share in the property., allowing unitholders to earn dividends from real estate investments without having to actually manage or finance any asset themselves.[29] For unlisted REITs, the investor base is limited to Professional Clients only while a listed REIT is open to all investors. Below is an illustration of how an asset owner can unlock capital by establishing a REIT:

Source: ADGM REIT Brochure (2017)

REITs – advantages and disadvantages

As per a PwC Report, REITs hold untapped potential in the UAE. This is evident from the fact that ‘the market capitalization of REITs compared to listed real estate is less than 3% in the UAE whereas in more mature markets such as the UK, France and the US at least 80% of the listed market capitalization in real estate is attributable to REITs’.[30]

Advantages

Regulatory certainty

REITs are a conventional capital raising mechanism. Owing to their regulated status, a REITs issuance is accompanied with detailed reporting and disclosure requirements. This gives comfort to fund owners/managers and inspires confidence amongst investors.

Offers diversification of portfolio, stable income and liquidity

REITs offer investors an opportunity to invest in a new asset class as opposed to traditional stocks, thus diversifying risk. Moreover, a REIT usually has a large number of properties under management. This means the viability of the portfolio is not contingent upon the success of one individual asset, which is the case when investing directly in a single property. [31]

Regulations mandate that REITs should pay out at least 80% of their annual net income to the unitholders. This assures investors of steady income along with the benefits of capital appreciation.

Additionally, listed REITs can be bought/sold just like stocks, which make them highly liquid.

Disadvantages

Expensive and time consuming

The process to set up, and list a REIT is time consuming and expensive, due to the high regulatory burden and need for a number of professionals (intermediaries) to manage the investment.

Conclusion

While crowdfunding is a flexible, accessible, and affordable option to raise funding, the exit options for funders are severely limited. Depending on whether one undertakes or is interested in reward/donation/equity or lending based crowdfunding, different digital platforms have emerged targeting different groups.

REITs are specific to real estate, offering a safe and diverse mode of investment. However, due to the number of intermediaries’ involved and regulatory compliances, setting up and managing REITs entails significant cost and managerial experience. Therefore, unless one has the necessary capital and assets, REITs may not be a viable capital raising mechanism.

Both crowdfunding and REITs are technology agnostic.

Tokenization, on the other hand, is a mechanism to tokenise on-chain and/or off-chain assets on a blockchain (or other distributed ledger technologies). The tokens thus created and recorded on the blockchain can be used for varied purposes – some of which are to raise funding by undertaking a STO (or any other variant of a coin offering) or to enhance efficiency of supply chain by using tokenised commercial documents (bills of lading etc.).

Not only can each of these mechanisms be utilized in isolation but hybrid models which use these mechanisms in conjunction with each other are on a rise. As an illustration, shares of REITs can be tokenized; reward-based crowdfunding can be accomplished by offering utility tokens on a blockchain; and equity-based crowdfunding can be effectuated through security tokens. Crowdfunded equity or shares of a REIT can be tokenised, making it possible to trade them on digital exchanges.

As the world is being increasingly expressed in 1s

and 0s, crowdfunding, tokenisation and REITs are all different mechanisms which

can be deployed in isolation or as composite models by entrepreneurs and

investors depending on the objective to be achieved, the kind of technology

being used and risk appetite.

| Fundraising Mechanism | Crowdfunding | Security Token Offering | Real Estate Investment Trusts |

| Best suited | – For projects under-development (including charitable endeavours), specially for client facing ideas/projects | – For investment in illiquid assets (on-chain or off-chain), with the added functionality of programmable governance | – For projects where primary investment class is real estate |

| Advantages | – Depending on revenue model, it is possible to structure crowdfunding in different ways – High level of transparency and valuable feedback from funders | – High liquidity – Immutable proof of ownership, security and transparency – Automation, reduced settlement times and better governance – Programmable tokens ensure automated compliance and versatility | – Regulatory clarity – Listed funds are liquid – Diversified portfolio. |

| Disadvantages | – Low Liquidity – Leaking of important information and copycats | – Legal and regulatory uncertainty – Lack of regulated infrastructure – Energy consumption | – Expensive and time consuming – Lack of granular investment options – Lack of transparency and limited control |

| Technology used | – Technology agnostic | – Distributed Ledger Technologies | – Technology agnostic |

About Ikigai Law

Ikigai Law is a law firm that specializes in representing technology businesses, investors, and start-ups, to more mature companies focused on new business models. We work with our clients on regulatory and policy issues, private equity and venture capital investment transactions, mergers and acquisitions and other commercial transactions, intellectual property, and disputes. Our work is at the intersection of law, policy, regulation, technology and business, engaging with crucial issues such as data protection and privacy, fin-tech, online content regulation, platform governance, digital competition, cloud computing, net neutrality, health-tech, blockchain and unmanned aviation (drones), among others.

About Arushi Goel

Arushi Goel (ex-Judge, India) is a legal advisor, based out of United Arab Emirates. She advises clients on commercial matters, venture capital investment transactions, regulatory compliances and issues relating to data protection, with a special focus on emerging technologies such as virtual asset service providers, blockchain, IoT and AI.

Reach out to us at contact@ikigailaw.com for more information.

Image credit: Pixabay

[1] Belleflamme P, Omrani N, Peitz M (2015) The Economics of Crowdfunding Platforms. DOI http://dx.doi.org/10.2139/ssrn.2585611.

[2] Roth, J., Schär, F. and Schöpfer, A., 2019. The Tokenization of assets: using blockchains for equity crowdfunding. Available at SSRN 3443382.

[3] Kivikangas, Inessa. “Online Crowdfunding Campaign for an Independent Video Game.” (2014).

[4] See https://gowercrowd.com/real-estate-insights/real-estate-crowdfunding-vs-reits-which-is-better

[5] See https://www.crowdfunding.com/types-of-crowdfunding/

[6] QY Research (2020), Global Crowdfunding Market Report, History and Forecast 2015-2026, Breakdown Data by Companies, Key Regions, Types and Application, https://www.qyresearch.com/index/detail/1638305/global-crowdfunding-market.

[7]Mordor Intelligence, Crowdfunding Market – Growth, Trends, and Forecasts (2020-2025) (2019), https://www.mordorintelligence.com/industry-reports/crowdfunding-market

[8] Smith, Anthony N. “The backer–developer connection: Exploring crowdfunding’s influence on video game production.” New Media & Society 17.2 (2015): 198-214.

[9] “Real Estate Crowdfunding vs. REITs: Which Is Better? www.gowercrowd.com/real-estate-insights/real-estate-crowdfunding-vs-reits-which-is-better.

[10] See Heater, Brian. “Kickstarter Issues New Transparency Guidelines for Projects.” www.techcrunch.com/2019/06/13/kickstarter-issues-new-transparency-guidelines-for-projects/

[11] This might change in the future as there are ventures in the pipeline working to create a secondary market for crowdfunded securities.

[12] Schwienbacher A (2019) Equity Crowdfunding: Anything to Celebrate? Venture Capital 21(1):65–74, DOI 10.1080/13691066.2018.1559010

[13] Lee, Jono. “Real vs. Fake Products: The Infamous Case of the Quickly Copied Fidget Cube.” Medium, Medium, 4 Dec. 2019, medium.com/@jobosapien/real-vs-fake-the-infamous-case-of-the-quickly-copied-fidget-cube-9b26a6161b36.

[14] William George, “Why Kleros Needs a Native Token”, Medium, 07 June 2018, https://medium.com/kleros/why-kleros-needs-a-native-token-5c6c6e39cdfe.

[15] PwC, 4 th ICO / STO Report A Strategic Perspective (March 2019 Edn.), https://cryptovalley.swiss/wp-content/uploads/ch-20190308-strategyand-ico-sto-report-q1-2019.pdf.

[16] PwC, 4 th ICO / STO Report A Strategic Perspective (March 2019 Edn.), https://cryptovalley.swiss/wp-content/uploads/ch-20190308-strategyand-ico-sto-report-q1-2019.pdf.

[17] World Economic Forum, Fourth Industrial Revolution for Earth Series: Building Block(chain)s for a Better Planet (2018), http://www3.weforum.org/docs/WEF_Building-Blockchains.pdf.

[18] See OECD (2019), The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series, www.oecd.org/finance/The-Tokenisation-of-Assets-and-PotentialImplications-for-Financial-Markets.htm.

[19] See See OECD (2019), The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series, www.oecd.org/finance/The-Tokenisation-of-Assets-and-PotentialImplications-for-Financial-Markets.htm.

[20] Deloitte, The Tokenization of assets is disrupting the financial industry (2019), https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/lu-tokenization-of-assets-disrupting-financial-industry.pdf.

[21] Vincent, David. “The Security Token Revolution – Canamex Gold Corp – Medium, www.edium.com/canamexgold/security-token-revolution-a1235a239032.

[22] OECD (2019), The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series, www.oecd.org/finance/The-Tokenisation-of-Assets-and-PotentialImplications-for-Financial-Markets.htm.

[23] See OECD (2019), The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series, www.oecd.org/finance/The-Tokenisation-of-Assets-and-PotentialImplications-for-Financial-Markets.htm.

[24] Deloitte, The Tokenization of assets is disrupting the financial industry (2019), https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/lu-tokenization-of-assets-disrupting-financial-industry.pdf.

[25] See OECD (2019), The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series, www.oecd.org/finance/The-Tokenisation-of-Assets-and-PotentialImplications-for-Financial-Markets.htm.

[26] Mt. Gox, www.investopedia.com/terms/m/mt-gox.asp.

[27] de Vries A (2018) Bitcoin’s Growing Energy Problem. Joule 2(5):801–805.

[28] “Energy Consumption – Crypto vs FIAT? www.ledger.com/energy-consumption-crypto-vs-fiat.

[29] https://www.reit.com/what-reit

[30] PwC Report, Emergence of Real Estate Investment Trust (REIT) in the Middle East (5th December 2018), https://www.pwc.com/m1/en/publications/emergence-real-estate-investment-trust-middle-east.pdf.

[31] Chen, James. “Real Estate Investment Trust (REIT) Definition.” Investopedia, www.investopedia.com/terms/r/reit.asp.